There is a formulation that tells you regardless of whether a shut-end is cost-successful.

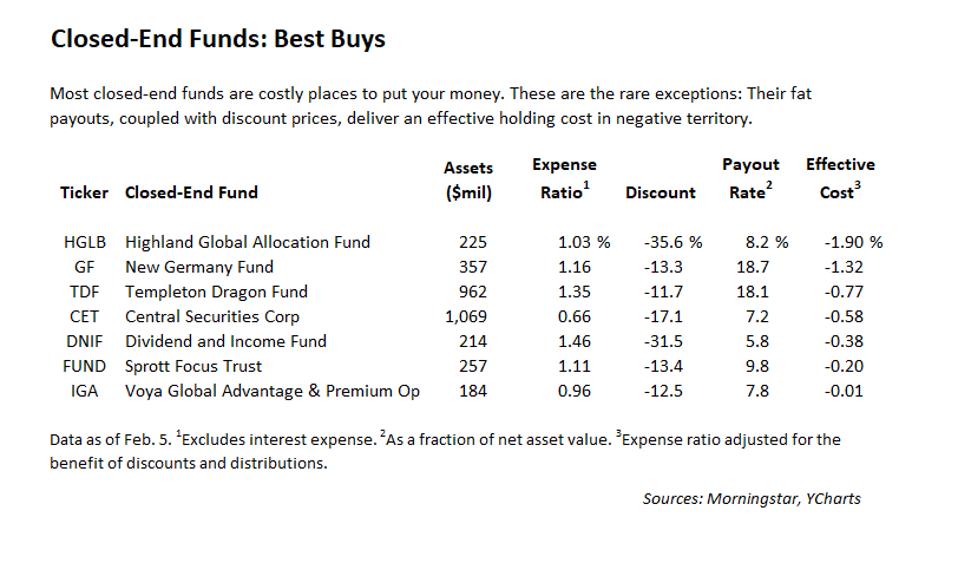

Closed-End Finest Buys

Acquiring bargains in closed-close funds is pretty the challenge these times. I went searching and observed a couple of. Very few.

What follows is a brief record of closed-ends that search cheap and a extensive rationalization of why you must be stay absent from the rest of the bunch.

A shut-conclude fund is a particular form of expense corporation that has its exit door locked. After money is inside, it can not go away. If you want to income out, you have to locate an additional customer eager to take your spot, and you might have to acknowledge a stingy give.

Contrast open-stop and exchange-traded resources. Open up-conclude, a.k.a. mutual, funds, funds out disappointed buyers by advertising off parts of their portfolios. ETFs leave the issue of liquidity in the arms of market makers who assemble and disassemble blocks of shares.

U.S.-registered shut-finishes, which keep $250 billion of assets, have lengthy given that been overtaken by mutual funds and ETFs, which maintain a put together $29 trillion. But there was a time when closed-ends towered above the competitors. Bankers concocted them at a furious rate and unloaded the shares at fat rates.

At the climax of the 1929 bubble, shut-ends traded at an normal 50% top quality to the price of their property. In their enchantment to the naive and in their capability to enrich insiders they were the counterpart to today’s special-goal acquisition organizations.

Noteworthy: a leveraged closed-conclusion called Goldman Sachs Trading Corporation. Shares peaked earlier mentioned $200. A number of several years later these shares were being likely for $1.75. That entity was sooner or later set out of its distress, but the closed-stop classification survived, and new members from time to time arrive into being.

These days shut-finishes frequently trade at a low cost to their asset price. But a price cut by alone does not make a fund into a excellent get. Try to remember that the operators of the fund are plucking costs from the portfolio and that the exit door is bolted. There is, in the meantime, a very small escape of pounds to independence, in the form of income distributions.

Any greenback you get in the form of a payout is a greenback you bought at a price cut, and you have an instant revenue on it. If a fund is investing at a 20% lower price to its belongings, and is shelling out out 5% of assets, then you are earning an excess 1% a yr on major of regardless of what the portfolio is carrying out for you. This arbitrage achieve may be enough to cover, or far more than protect, the quantity getting drained away in fund expenses.

So here’s my formulation for pinpointing if a closed-stop is a worth enjoy. Multiply the discounted by the payout amount. If that product or service is bigger than the cost ratio, then the fund is value a appear.

I pawed by a Morningstar databases of 418 closed-finishes with at the very least $100 million in property. Potential bargains: a mere 7, exhibited in the table.

There is possible below, but not any incredible purchases. These bargains come with caveats: The expenditures may well go up, and the payouts may well decline.

The most intriguing of the whole lot is Highland International Allocation Fund. It’s uncomplicated to see why shareholders are nervous to depart. The final annual report information such holdings as pipeline partnership shares worthy of a 3rd of the $51.6 million compensated for them, a selection of senior financial institution loans with related general performance, bonds from Argentina and a brief place in technological innovation stocks. Yikes.

You could be eager to wager that these very contrarian plays are about to spend off. If they do, the lower price would in all probability slim and you’d have a double acquire. In the meantime, the distributions give you a stream of modest arbitrage gains truly worth not pretty 3% a calendar year, easily a lot more than losses to fund expenses.

This is, as I claimed, a wager. Highland’s investments may possibly carry on to sag. If they do, the low cost will probably widen. In that circumstance your losses will be accentuated.

Sorry that this is the ideal I can do for a bullish circumstance on closed-finishes. The group just is not incredibly promising at the moment, with the marketplace hitting new highs. If we get a crash of the 1929-1932 range you could see bargains reappearing.

Don’t neglect that caveat about distributions slipping. This is a possible hazard at the Highland fund, and is all the more so at the subsequent two funds on the list. These shut-finishes, investing in German and in Asian shares, have been paying out cash gains that you can scarcely count on.

There are two more issues to be wary of. Just one is the notion that a low cost deeper than the historic typical for a fund is especially probably to narrow, providing a windfall to you. It’s just as probably to go the other way.

The other is the idea that when you buy at a price reduction your returns are magnified due to the fact you have far more pounds performing for you in the portfolio. Alas, the arithmetic does not function in that fashion. Say you acquire a $10,000 portfolio at a 20% discount and the portfolio returns 50%, expanding to $15,000. At the identical 20% price reduction your fund shares are now really worth $12,000. You’ve earned precisely the 50% return on a $8,000 investment decision you would have had putting your cash into an open up-stop fund.

Just before shopping for a closed-close fund, contemplate the alternate: a minimal-price ETF or mutual fund. There are lots to pick out from that have small expenditure ratios. See Guide To Inventory Index Funds: 97 Greatest Purchases. To be desirable, a closed-conclude should really have an efficient keeping charge that is lower than little. It must be underneath zero.