The entice of lithium, the metal dubbed white petroleum, has proved irresistible for Gina Rinehart, Australia’s richest particular person and just one of the world’s richest ladies.

But her entry into just one of the commodities remaining driven bigger by robust demand for the batteries utilized to ability electrical motor vehicles (EVs) is much from regular.

Although there are a lot of chances closer to her household city of Perth on Australia’s west coastline, Rinehart has bought into a German lithium job that has currently attracted her son, John Hancock.

Gina Rinehart at Roy Hill’s berths in Port Hedland.

The presence of mom and son on the share register of Australian outlined Vulcan Strength is unconventional as the two have had a complicated connection thanks to a dispute about the phrases of a family have faith in which became a factor in John altering his surname to that of his grandfather, the late Lang Hancock.

Rinehart’s fortune, approximated by Forbes at $17.2 billion, is primarily based on the mining of iron ore in Western Australia.

The sizing of her stake in Vulcan has not been unveiled but her learn company, Hancock Prospecting, is outlined as a cornerstone investor in a $92 million ($A120 million) cash boosting accomplished very last week. John Hancock uncovered his 5.23% keeping in Vulcan last thirty day period.

“Zero Carbon Lithium”

The appeal of Vulcan, which lists Goldman Sachs has one particular of its large-powered advisers, is that the lithium it proposes to deliver at website in close proximity to Mannheim in the Rhine Valley will be promoted as the world’s first “zero carbon lithium.”

The claim of staying very environmentally welcoming is based mostly on the generation method, which will entail extracting extremely scorching, lithium-abundant brine that will be both of those the resource of the lithium and the steam to push electric power creating turbines to electric power the operation.

The initial phase of the process will use verified geothermal engineering to faucet into the deep brine. The 2nd stage will see lithium extracted with the applied brine re-injected guaranteeing no squandered h2o. The last stage will see the manufacturing of lithium hydroxide, the chemistry chosen by battery makers.

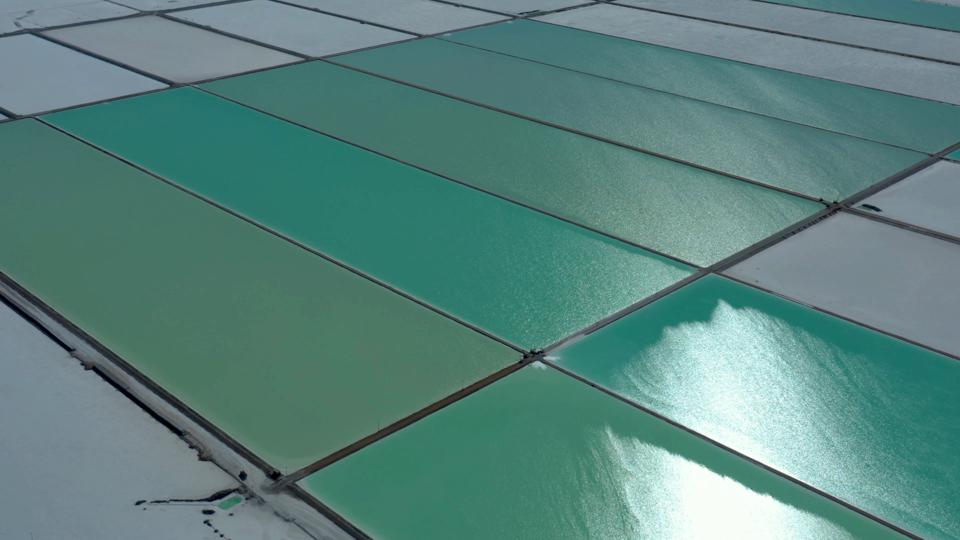

Lithium production in Bolivia, using the solar to evaporate surplus h2o. Photographer: Pablo … [+]

Vulcan’s proposed lithium output technique is radically different to the evaporative ponds employed in Chile and other South American international locations to dry salt-prosperous water, or the tricky-rock mining popular in Western Australia, household to some of the world’s greatest lithium mines.

But what would have appealed to Rinehart and Hancock is the prospective price tag edge of the Vulcan task with the organization saying that its lithium hydroxide will value $3,142 for every ton versus $6,855/t for tough rock lithium and $5872/t for evaporative brine processing.

Nearby Car or truck Makers

One more probable benefit is that the Rhine Valley area is near to some of the world’s largest motor vehicle and battery-building factories.

Vulcan’s novel lithium production plan has been introduced just as other lithium producers shift to restart tasks mothballed after the selling price of lithium crashed a few decades ago.

Albemarle Corporation, which controls a range of lithium initiatives in South The united states and Australia, is in the method of increasing $1.3 billion in clean capital to satisfy quickly-growing need from battery makers.

Australian difficult rock lithium generation. Photographer: Carla Gottgens/Bloomberg

Around the previous two months, the price of lithium has risen by 40% to all around $10,000/t when offered as lithium carbonate, the most usually traded type of the metallic, even though it is nonetheless very well short of the boom-time rate of $26,000/t achieved in the to start with flush of the battery hurry in late 2017.

Vulcan shareholders, together with Rinehart and some others who participated in the the latest funds elevating, have created handsome gains.

New shares issued by way of the funds boosting have risen by 38% in less than a week from the concern cost of $5 ($6.50) on February 2 to closing trades on the Australian inventory sector now at $6.90 ($A9).

Three months in the past, Vulcan shares were being investing at 80 cents ($A1.03).