U.S. oil manufacturing has fallen additional than 2 million barrels per working day due to the fact March 2020. Many fairly count on that DUCs (drilled uncompleted wells) provide a option to output falling more.

They will not.

There are about 5,800 DUCs in the most important U.S. restricted oil performs. These are currently drilled and could be transformed into developing wells for the cost of completion which is about fifty percent the full nicely expense.

Most DUCs, however, are uncompleted for a rationale particularly, that their entrepreneurs never believe that their functionality will be as superior as wells that they chose to complete in its place.

Even assuming very similar overall performance, the greater problem is that massive numbers of DUCs are previously getting completed and official EIA 914 production remains a lot less than 10.5 mmb/d.

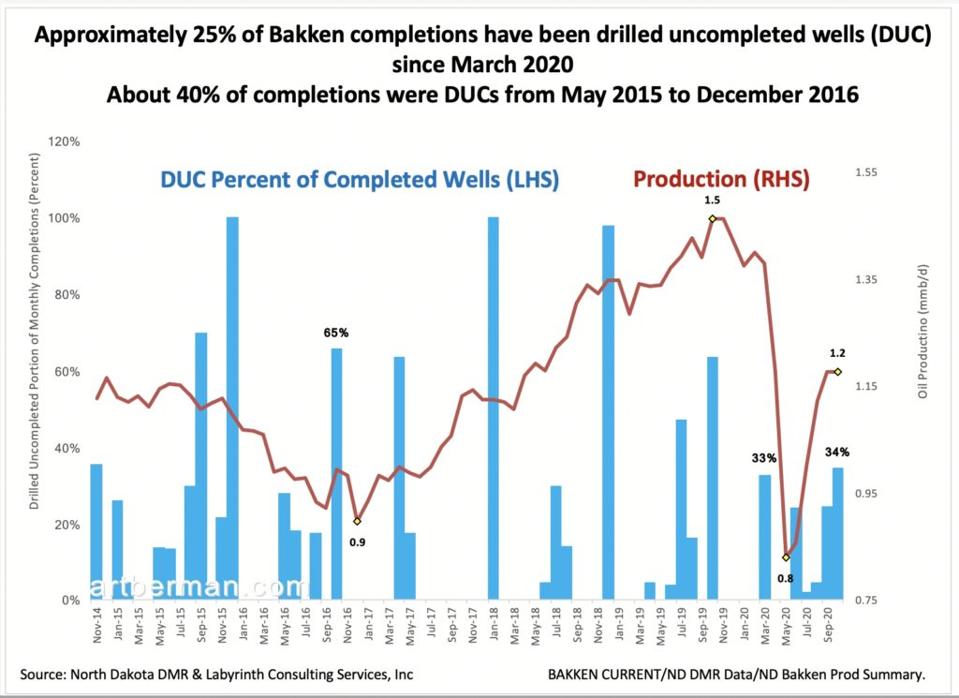

North Dakota publishes regular information on DUCs that can be when compared with active, generating wells.

DUCs at the moment account for about 35% of new Bakken generating wells and about 25% of finished wells because March have been DUCs (Figure 1).

Determine 1. About 25% of Bakken completions have been drilled uncompleted wells (DUC) considering the fact that … [+]

All through the 2015-2016 oil price tag and creation collapse, DUCs in the Bakken achieved about 40% of completions. It is, for that reason, affordable to assume that latest DUC stages may perhaps be shut to a most. Whether or not Bakken info applies to other plays is, of course, not known.

Far more importantly, there are just far too few wells currently being concluded to hope U.S. production to keep 11 mmb/d EIA forecast for 2021.

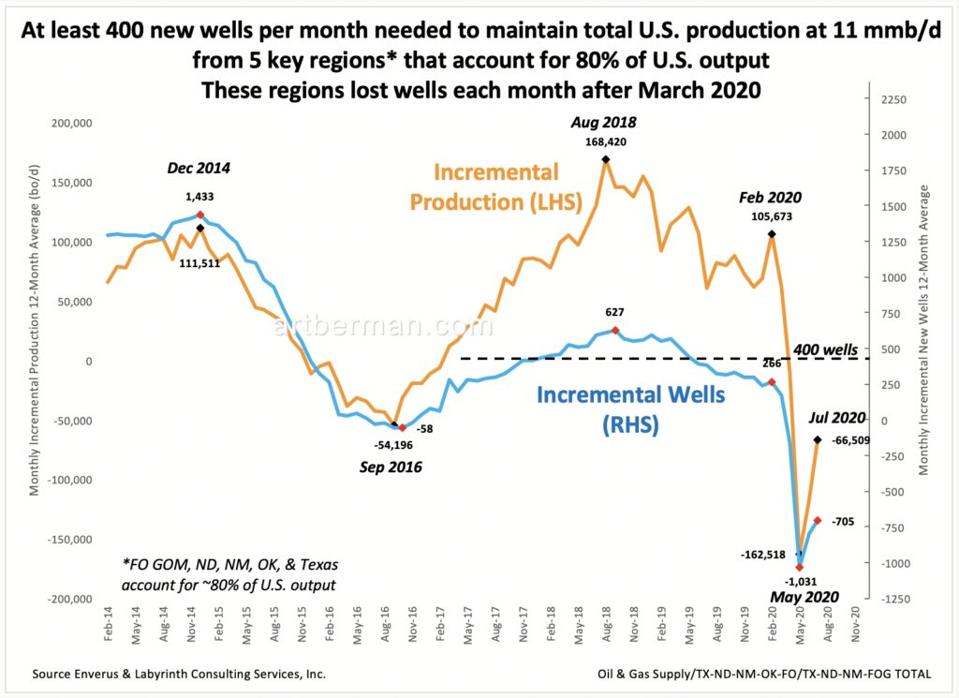

Five key areas of the United States—Texas, North Dakota, New Mexico, Oklahoma and the offshore Gulf of Mexico—account for 80% of total output. Determine 2 reveals incremental new wells and new manufacturing for individuals regions from 2014 by July 2020 (12-thirty day period ordinary).

Figure 2. At least 400 new wells per month desired to retain full U.S. creation at 11 mmb/d from … [+]

At minimum 400 new wells will have to be added every single thirty day period to offset declining legacy creation and sustain 11 mmb/d for the U.S. Instead of incorporating new wells, fewer wells have been drilled in every successive thirty day period immediately after March 2020. Not incredibly, incremental month to month production has been slipping and that is fully dependable with declining all round production stages.

It doesn’t make a difference irrespective of whether wells are freshly drilled and concluded or DUCs—there are basically far too several wells getting included to sustain existing levels of production.

How Much Will Creation Tumble?

The great information is that properly completions and rig counts have turned all over and are now heading in the suitable direction. The terrible information is that it will take quite a few months right before drilling and generation equilibrate. How far will creation tumble?

The reality is that no one is familiar with. Oil generation is section of a sophisticated system. Its interdependencies and feedback loops make it dynamic and adaptive. There are unresolvable uncertainties. The greatest method is to determine and describe the essential designs that characterize existing point out: rig rely, decline prices, lags and qualified prospects, completions and incremental production fees. These give the most possible but only notional projections of those people trends.

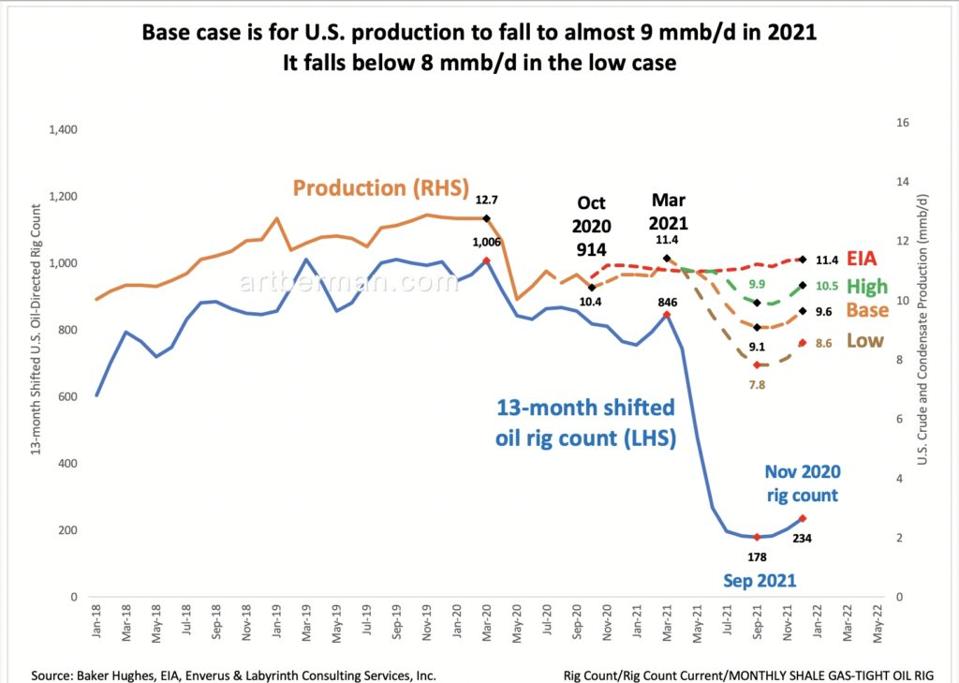

In Determine 3, I show a few scenarios based on rig count and I also present EIA’s output forecast for 2021. These need to be considered as trend strains instead than forecasts.

Figure 3. Foundation scenario is for U.S. output to slide to almost 9 mmb/d in 2021. It falls beneath 8 mmb/d … [+]

In the foundation case, output starts to drop in April 2021 and decreases to 9.1 mmb/d by September 2021. In the minimal scenario the generation minimum is approximated at 7.8 mmb/d and in the significant situation, 9.9 mmb/d.

No matter what the magnitude of generation decrease or its specific timing, it is crucial to figure out what is coming. The decrease-for-more time ruling paradigm has been accurate and useful since the oil-value collapse in 2014. What is taking place now is various.

It is not likely that the limited oil business enterprise will recover from the outcome of Covid-19 and lower oil selling prices. Markets will continue to send higher rate alerts right until rig counts get better to the 800 or so rigs desired to assist EIA’s 11 mmb/d forecast.

The community and numerous buyers have the peculiar perception that the globe will be just great without oil. The planet will be wonderful. It has survived meteor impacts and mass extinctions but individuals are a lot more fragile. Bigger oil prices are the very last detail the global economy requirements right now.

For a much more specific version of this tale, go to artberman.com