Although not as controversial as a stock like Tesla (TSLA) – Get Report, Lemonade (LMND) has definitely found itself in concentrate about the previous couple of months.

The bears are growing disappointed that the new issue has climbed so considerably so fast. Bulls proceed to champion the inventory, even immediately after its monstrous run.

Lemonade inventory has notched a new higher for 4 straight buying and selling periods, including Tuesday. That’s astonishing to some traders, supplied that the company introduced a secondary supplying.

The stock was up nearly 3% at a person position on Tuesday after opening lessen by far more than 7% and falling much more than 9% at the lows. Currently, the shares are down 3% to 4%.

Now the concern results in being: Will buyers drink in the secondary and squeeze this stock up to new highs, or is the short-term substantial in area?

Buying and selling Lemonade Inventory

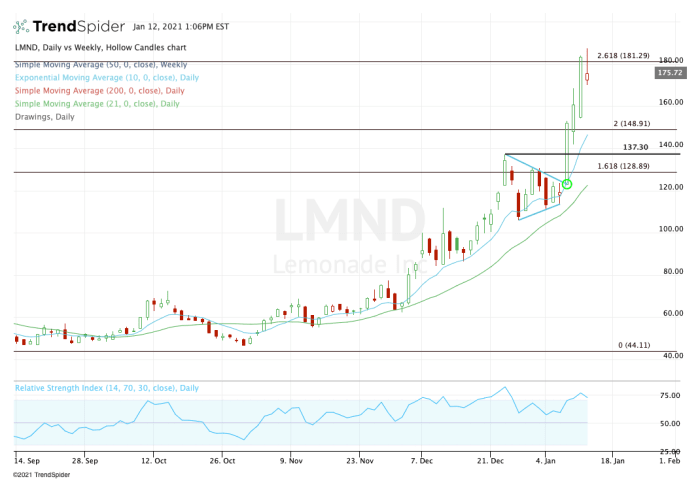

After a solid run in early December, Lemonade stock consolidated into assist at the 10-working day relocating average ahead of igniting greater.

The inventory topped out at $137.30 — the significant for the thirty day period and for 2020 — in advance of consolidating again. This time, though, the consolidation took the form of a tightening wedge.

When Lemonade stock blasted by way of wedge resistance and the prior 2020 superior, it rapidly raced up through the two-occasions assortment extension and briefly cleared the 261.8% extension.

Now the stock is struggling with that 261.8% extension, which is fair immediately after these a enormous run.

From right here, I want to give Lemonade some time to digest this hottest rally. Retain in thoughts: The shares are nonetheless up pretty much 50% from the close on Jan. 6 and that is following the stock rallied more than 76% in December.

On the downside, let us see how the stock handles a pullback to the 10-working day transferring normal. If it’s assistance, bulls could see a sturdy bounce.

On a break of the 10-day transferring regular, glimpse for a retest of the 2020 superior at $137.30 and/or a exam of the 21-working day relocating common, whichever will come initially.

Need to the shares choose out the 261.8% extension and this week’s superior at $188.30, then $200 and the a few-situations variety extension at $201 are in perform.