Nation-wide risk of business default worsens as inflation bites: Report

The threat of default above the next 12 months has greater in all areas across Australia owing to labour shortages, growing prices, curiosity level hikes, and offer chain complications.

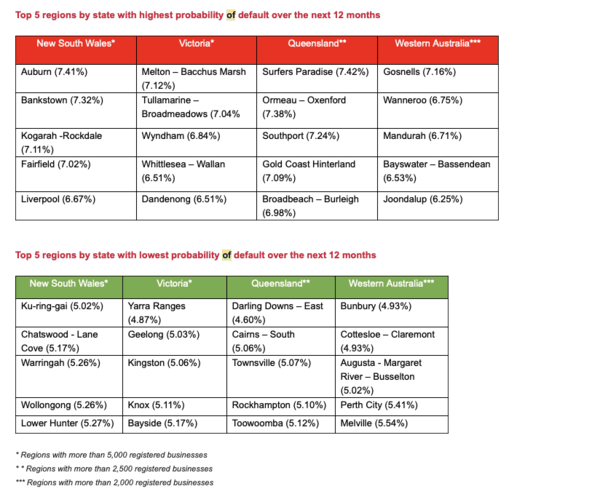

The September 2022 CreditorWatch Company Threat Index (BRI) discovered that the chance of default more than the future 12 months has developed in all regions throughout Australia with 5000 or far more registered firms, except New South Wales’ Reduce Hunter and Wyong regions. Organizations are having a difficult time from the east coastline to the west coastline.

Highlights:

- Court docket steps are up 60 for every cent 12 months-on-yr.

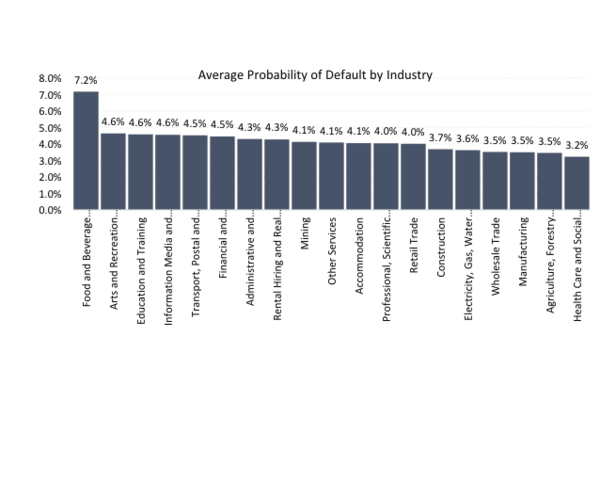

- The industries with the greatest likelihood of default in excess of the upcoming 12 months are: Food stuff and Beverage Companies (7.20 for every cent) Arts and Recreation Providers (4.68 for each cent) and Education and learning and Instruction: (4.63 per cent)

Trade action still down

A a lot more encouraging growth is that year-about-year development in B2B trade receivables has continued to increase, which indicates that little enterprises’ trade activity has ongoing to boost given that COVID. Nevertheless, quantities are however significantly below pre-covid amounts.

Trade action has been steadily falling for some time, but it is now rebounding to far more typical concentrations. The data signifies that there are however restrictions on how our customers are impacted by steps that weren’t existing just before Covid. These limitations ordinarily occur from a absence of merchandise or a protracted hold off in having them, specially in the construction market, as well as labour constraints that prohibit enlargement or enterprises from performing at complete ability.

Hence, even even though each countries’ labour drive info are however quite sparse, the details on open up positions implies that firms’ need to employ the service of new staff members has lowered. The RBA is clearly becoming a lot more thorough in its solution to tightening monetary policy as some indications commence to display that their hard cash price hikes are commencing to have an effect. It may possibly take some months before this slowdown begins to show up in labour force info.

CreditorWatch CEO Patrick Coghlan explained B2B trade payment defaults confirmed a dip this month however, these continue to be properly over degrees found in September very last year for the duration of Covid and are a guide indicator of long term defaults.

“Payment defaults are hugely substantial and are a vital indicator of coming delinquency for the debtor/client. Roughly 25% of corporations with default conclude up in administration inside 12 months. Furthermore, it places tension on the supplier, who will now have to shoulder that poor financial debt. A organization with a trade payment default is seven times the default danger as opposed to a small business with a clear payment history.”

The massive image

There has been a drop in the price of the Australian dollar immediately after the central lender shocked buyers by choosing to raise desire premiums by a smaller-than-envisioned quarter place.

The cash level aim was elevated by 25 foundation factors to 2.60 per cent by the Reserve Lender of Australia. In addition, it raised the desire price on Exchange Settlement balances by 25 foundation details to 2.50 for every cent.

Moreover, the Expertise Priority Checklist (SPL) found out that 286 positions are now in reduced provide, up from 153 at the identical time in 2021. Nationally, shortages ranged from apiarists, veterinarians, nurses, and lecturers to scaffolders, technicians and trades employees, miners, and landscape gardeners. Resort administrators, bus drivers, blacksmiths, and magnificence salon professionals are amongst the notable new additions to the expertise shortages.

ALSO Study: SME sentiment is weakening regardless of increased profitability. Here’s why

The announcement verifies numerous sector groups’ fears about the persistent qualified workforce scarcity impeding company action across Australia.

Anneke Thompson, Main Economist, CreditorWatch says: “Our Business enterprise Threat Index (BRI) details for September 2022 was broadly constant with info tendencies we have recorded about the previous months. Trade Receivables keep on to boost annually, indicating that enterprises are nevertheless experience relatively assured and that supply and labour bottlenecks are little by little clearing up.

“This thirty day period we also saw the Reserve Bank of Australia (RBA) commence to shift a lot more cautiously by its financial coverage tightening cycle, with only a 25 bps maximize in the cash fee. Each month-to-month Labour Drive and quarterly Task Emptiness knowledge that have been launched lately advised that the unemployment rate may perhaps have arrived at its trough.

“The unemployment price amplified pretty a little to 3.5 per cent, from 3.4 for every cent the thirty day period prior, though the number of careers obtainable lessened by 2 per cent (or 10,000 employment) above the three months to August. This will be welcome news for business enterprise proprietors, most of whom have been struggling to come across workers to fulfill need. It will also just take some force off wage raises. Continue to, work vacancies are at extraordinarily higher amounts on prolonged-phrase actions, and it will just take numerous months to normalise.”

As a result of increasing fuel and meals rates, which have reached a 20-calendar year large, the Australian economic climate is dealing with problems. This 12 months, the RBA has hiked prices 6 instances. While the RBA still left the door open up to a lot more hikes as it “assesses the potential customers for inflation and financial advancement in Australia.”It claimed that it had opted to pause the pace of tightening because the cash fee experienced been elevated significantly in a shorter period of time of time.

Way ahead

Despite favourable demand and trade conditions for firms at the minute, analysts are continue to waiting around for customers to come to feel the effects of desire level will increase completely.

There are some early indications that, equally domestically and throughout the world, organization conditions have peaked. According to latest Abdominal muscles Task Emptiness knowledge, there ended up fewer employment obtainable in Australia in August than there have been in Might. Related developments may well be found in the stats from the US.

So, while labour force information is even now really tight in equally countries, the vacancy info suggests that positions are now starting to be loaded at a bigger level, and businesses have slowed their hunger for staff.

It may possibly just take some months ahead of this slowdown starts off to demonstrate up in labour force details, but clearly, the RBA is being more cautious in their technique to financial plan tightening as some indicators commence to present that their income amount hikes are setting up to just take outcome.

Click here for CreditorWatch Business Risk Index report.

Simply click here for more insights into the top rated and best performers.

Hold up to date with our tales on LinkedIn, Twitter, Facebook and Instagram.