Portra/E+ via Getty Images

Though the supermarket industry may not seem all that attractive to many investors, the fact of the matter is that there are some firms that thrive in this space. One company that has performed exceedingly well recently is Ingles Markets (NASDAQ:IMKTA). Over the past several years, management has succeeded in steadily and consistently growing the company’s revenue. Profitability has followed suit. This has taken place even as the number of stores remains more or less fixed. Add on to this the fact that shares of the business are trading on the cheap, both relative to peers and on an absolute basis, and I cannot call this anything other than a ‘strong buy’ prospect.

Performance continues to improve

The last time I wrote about Ingles Markets was in an article published in January of this year. At that time, I praised the attractive growth of the company, both on its top line and its bottom line. I also acknowledged just how cheap shares were and called the enterprise an excellent play on the retail market. Since then, the business has performed even better than I anticipated when I wrote about it. While the S&P 500 has seen a decline of 9.9%, shares of Ingles Markets have generated a return for investors of 16.1%.

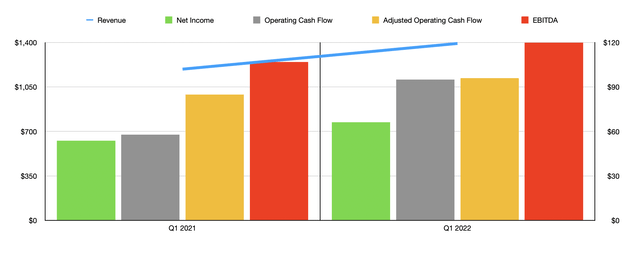

Author – SEC EDGAR Data

When I did write my aforementioned article on the firm, the most recent financial data we had for the business extended through the entirety of the company’s 2021 fiscal year. Today, we now have data covering the first quarter of its 2022 fiscal year. What’s really exciting here is that, in such a short period of time, the business continued to generate strong upside from a fundamental perspective. Consider, for instance, the company’s revenue. Sales for the first quarter of the company’s 2022 fiscal year came in at an impressive $1.39 billion. This compares to the $1.19 billion in revenue generated the same time one year earlier.

For those who are new to analyzing the company, the initial thought might be that the 16.9% increase in sales was attributable to a rise in store count. But in fact, the number of stores the company operates only grew by 1 from one timeframe to the next. Instead, management chalked this growth up to a few different factors. For starters, the company attributed some of the sales growth to higher revenue associated with gasoline sales as gas prices increased. The company also saw more gallons sold thanks to increased holiday travel. Excluding gasoline sales, the number of customer transactions for the business grew by 7.3% year over year, even as the average transaction size jumped by 3.4%. In dollar terms, gasoline sales jumped by 72.7%. The next fastest-growing sales category for the company was its line of perishables. Year over year growth there was 13.4%. But the company also saw nice growth in grocery products and non-foods. All in all, for the quarter, sales per square foot came in at 123 dollars. That compares to the $105 one year earlier.

As revenue rose, so too did profitability. Net income for the latest quarter came in at $66.2 million. This compares to the $53.8 million generated just one year earlier. This 23% increase was driven in large part by the company’s stronger sales. But we also saw the firm’s margins improve as well. For instance, even though gross profit relative to sales decreased, the company saw its operating and administrative costs drop from 20% of sales to just 18.7%. Of course, there are other profitability metrics that we should look at. One of these is operating cash flow. For the quarter, this number came in at $95 million. This is nearly double the $57.8 million reported just one year earlier. If we adjust for changes in working capital, the picture does look a little more even, with cash flow rising from $84.8 million to $96 million. Meanwhile, EBITDA for the company also expanded, rising from $106.8 million in the first quarter of 2021 to $119.8 million the same time this year.

We don’t really know what the rest of 2022 will look like. And management has not provided any detailed guidance on this matter. However, if we analyze results experienced in the first quarter, the firm should see net profits for 2022 of around $307.3 million. Operating cash flow should come in at around $346.8 million, while EBITDA should total around $521.8 million. These numbers compare favorably to the $249.7 million, the $306.3 million, and the $465.2 million, that the business saw, respectively, during its 2021 fiscal year. Taking this data, we can then effectively price the company.

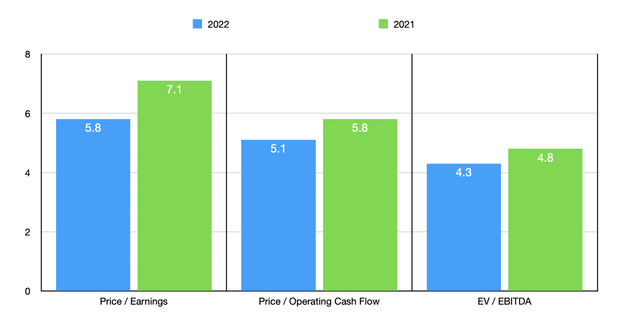

Author – SEC EDGAR Data

Using the company’s 2021 results, we find that it is trading at a price to earnings multiple of just 7.1. This drops considerably to 5.8 if we rely on 2022 estimates. The price to adjusted operating cash flow multiple should be 5.8. That number should decline to 5.1 if my 2022 estimates turn out to be accurate. Meanwhile, the EV to EBITDA multiple for the company should be 4.8 if we use the 2021 figures. That number should drop to 4.3 if the 2022 estimates are correct. To put the pricing of the company into perspective, I decided to compare it to the same five companies I compared it to in my last article. On a price-to-earnings basis, these companies ranged from a low of 11.1 to a high of 53.4. Our prospect was the cheapest of the group. Using the price to operating cash flow approach, the range was from 4.9 to 20.2. And using the EV to EBITDA approach, the range was from 4.3 to 21.8. In both of these scenarios, only one of the five companies was cheaper than our prospect.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| Ingles Markets | 7.1 | 5.8 | 4.8 |

| Grocery Outlet Holding Corp. (GO) | 53.4 | 20.2 | 21.8 |

| Natural Grocers by Vitamin Cottage (NGVC) | 17.9 | 8.6 | 7.1 |

| Sprouts Farmers Market (SFM) | 14.2 | 9.5 | 5.8 |

| Casey’s General Stores (CASY) | 23.4 | 11.1 | 11.9 |

| Albertsons Companies (ACI) | 11.1 | 4.9 | 4.3 |

Takeaway

At this point in time, Ingles Markets is performing exceptionally well. Long term, I suspect this trend will continue. Even if it doesn’t, shares are priced low enough today that even a scenario where business stagnates could warrant additional upside for shareholders. Because of all of these factors, I cannot help but to maintain my ‘strong buy’ rating for the business at this time.